High energy bills and high levels of inflation are hitting Americans’ pocketbooks hard and concern over climate change continues to rise. The private sector faces the unique challenge of developing solutions that maintain affordable, secure energy and reduce emissions. As technologies such as wind and solar power receive the lion’s share of the attention, one lesser-known solution is carbon dioxide removal (CDR).

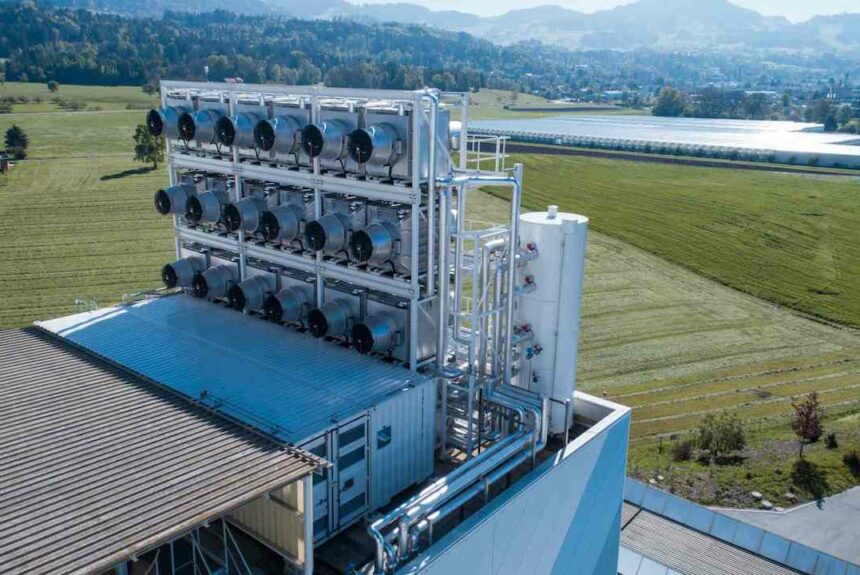

CDR is exactly what it sounds like: removing carbon dioxide from the atmosphere. Methods of CDR include natural solutions like tree planting and soil carbon sequestration and technological advances like direct air capture facilities. Direct air capture (DAC), which is a form of CDR that involves using chemical reactions and large fans to pull CO2 from the atmosphere, is a relatively new technology that has begun to receive increased attention.

In a new report, called Opportunities for Competitive Policy Mechanisms to Improve Carbon Dioxide Removal, Phillip Rossetti of R Street and Nick Loris of C3 Solutions explore the role that CDR can play in reducing emissions and addressing climate change. The authors write:

“CDR offers a promising and potentially transformative option for reducing the costs of climate change and lessening the risk of high-impact tail scenarios. The Intergovernmental Panel on Climate Change (IPCC) emphasizes that CDR is an essential complement to greenhouse gas mitigation strategies that seek to limit human-induced warming to two degrees Celsius above pre-industrial levels. 3 Carbon removal technologies, if cost effective, could help address the collective action problem that makes global emissions reductions challenging. Moreover, purchasing carbon removal credits could be advantageous for firms, particularly for sectors of the economy that are challenging to decarbonize.”

The private sector has begun to take notice of CDR and direct air capture technology. Earlier this year Stripe, Alphabet, Meta, and McKinsey teamed up to form Frontier, which will commit nearly $1 billion to emerging carbon removal technologies and companies. As Rossetti and Loris point out in their report, private sector interest is likely to grow:

“The demand for CDR credits will only keep growing. Several major oil companies, including British Petroleum, Royal Dutch Shell and Total, have committed to achieving carbon neutrality by 2050. While this could theoretically be achieved through carbon offsets, firms will likely seek to procure as many CDR credits as possible.”

In the 2021 Infrastructure Investment and Jobs Act (IIJA), the federal government allocated $3.5 billion over five years to establish four regional DAC hubs. The funding, which will be administered by the Department of Energy (DOE), will be awarded to companies, industry leaders, national labs, and universities. If implemented correctly, “each [will] have the capacity to capture and store and/or utilize one million metric tons of CO2 per year,” according to DOE.

Implementing legislation to capitalize on this momentum is tricky as lawmakers will need to remain mindful of implementing smart policies that support CDR without crowding it out, “an economic phenomenon in which public spending or procurement has displaced private consumers,” according to the authors.

To further spur CDR technologies, Rossetti and Loris recommend that lawmakers consider what a credit system would look like. As they explain:

“In considering policy design that would stimulate market entry for CDR technology, policymakers must consider what a CDR credit should look like in the future. The hope for a CDR credit is that it would be low cost, abundant and accessible to private actors— which is to say, available to consumers and firms that are not politically connected. In effect, CDR credits should look more like solar panels, available to any who choose to buy them freely on the market.”

They continue:

“Generally, the more neutral the government is in any sort of subsidy mechanism, the more efficient outcomes tend to be; the more specific the government is, the worse the outcomes are. If the U.S. government subsidizes CDR technology, it should avoid mechanisms similar to the Production Tax Credit (PTC) or Investment Tax Credit (ITC).”

As climate change remains a top priority on the global stage, the United States can continue to lead the world in energy innovation by implementing policies that allow the private sector to spur carbon dioxide removal (CDR) technologies.

The views and opinions expressed are those of the author’s and do not necessarily reflect the official policy or position of C3.