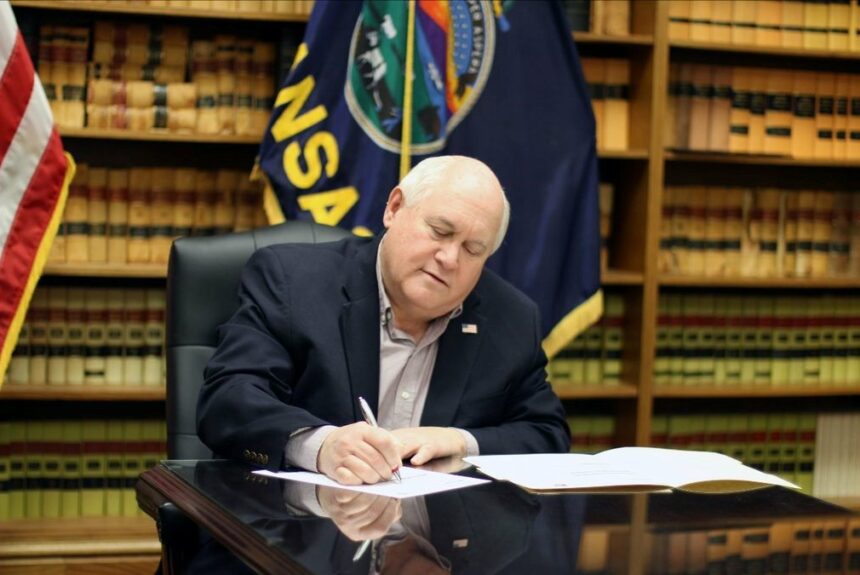

In an election year, Congress often grinds to a halt as members raise money and campaign for reelection. The House of Representatives recently bucked this trend by passing a large, bipartisan tax bill called the Tax Relief for American Families and Workers Act. This bill includes provisions to extend immediate expensing for research and development through 2025, a policy that expired in 2022. Rep. Ron Estes (R-KS), has long been a leader in efforts to make immediate expensing a permanent fixture in the tax code. He recently joined RIght Voices to talk about parts of the bill and some of the economic benefits they may provide.

For more than 70 years businesses have been able to deduct expenses for research and development expenses in the year that they occurred. This incentivized investment in R&D and allowed America to become a global leader in technological breakthroughs and innovation.

>>>READ: Bipartisan Tax Agreement with Immediate Expensing Will Kickstart Innovation

This deduction expired in 2022 and businesses were forced to amortize their expenses over five and 15 years for domestic and foreign R&D, respectively. This has made it more difficult and costly for companies to invest in R&D. As Rep. Estes explained:

“We were averaging about 6% growth on research and development expenditures, and after that expired in 2022, that dropped to less than 1%. It’s so important for us to be able to look to the future. And we know that so many jobs follow research and development, as well as the jobs in doing the actual research and they’re well paying jobs, which are good to have in America.”

While this change will hurt all businesses, it will have an outsized impact on smaller ones. Absent a policy change, the R&D Coalition expects that R&D spending in the United States will fall by more than $4 billion annually in the next five years and by $10 billion in the five years that follow.

Importantly, the U.S. is one of the only countries that taxes innovation in this way, according to Congressman Estes.

“The United States is only one of two countries in the developed world that actually require you to amortize [R&D expenses] over five years or longer. And so we’re competing against countries like China, where they’re giving you a 200% deduction on your first year. So it’s incredibly, incredibly important for us to help get more workers in the United States and actually continue our economic growth.”

In addition to championing pro-growth tax policy to help the economy and environment, Congressman Estes is also advocating for balancing the federal budget. He recently introduced the Business Cycle Balanced Budget Amendment, which would require the federal government to balance the budget and rein in spending.

Rep. Estes notes that the government is paying more in interest than on non-defense discretionary spending. By this time next year, it will be paying more in interest than everything it spent on defense. This exorbitant debt not only saddles future generations but also hamstrings businesses and the federal government from investing in research and development.

>>>READ: Three Ways Immediate Expensing Helps the Environment

American consumers have experienced high inflation which has impacted every part of their lives in the last few years. Members of Congress, led by Rep. Estes, are looking to provide relief with a set of pro-growth tax policies that will provide economic and environmental benefits.

The views and opinions expressed are those of the author’s and do not necessarily reflect the official policy or position of C3.