America is a global leader in research and development thanks largely to the private sector and a robust network of federal laboratories, universities, and supportive policies. Private and public investments in R&D have helped create the Internet, GPS, cost-effective air conditioning, artificial intelligence, and many other luxuries that power modern-day living. While it is easy to take these technologies for granted in the U.S., innovators and entrepreneurs must endure an arduous and lengthy process to bring new technologies to market.

>>>READ: Three ARPA-E Startups that are Accelerating Energy Innovation

A new report from the Bipartisan Policy Center (BPC) titled “From Idea to Impact” delves into this process through the lens of clean tech and provides recommendations to speed up the timeline to commercialize innovative ideas and technologies.

The federal government has significantly increased its investments in applied research and development over the past several years. Despite this, startups are still struggling to scale up due to slow tax guidance and poor implementation amongst federal agencies, lengthy permitting timelines, and significant funding challenges. As the report notes:

[C]hallenges include long R&D periods, strict product safety standards, workforce issues, complex permitting requirements, and infrastructure needs, and the significant funding required to achieve commercial scale…Addressing these challenges will be vital as the United States works to drive broad-based decarbonization, strengthen its manufacturing sector, and ensure that the benefits of early-stage innovation accrue to U.S. workers and businesses as companies scale.

One real-world example of the challenges that startups face is Tesla. While the company is today one of the most profitable in the world, it had to raise about $14 billion from private and public investors, and government loans, before achieving positive cash flow for the first time in 2019 (16 years after it was founded). Tesla’s story is not unique. For many startups accomplishing market-scale growth can take several years and cost hundreds of millions of dollars to achieve. As BPC illustrates:

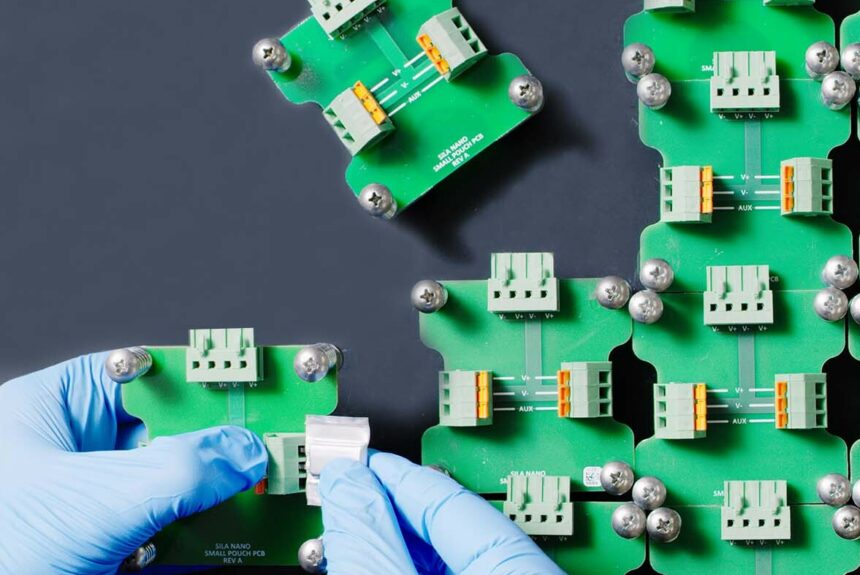

The report provides several case studies of startups that navigated the long and complicated commercialization process, one of which being Sila Nanotechnologies, a battery material provider for EVs and commercial products.

Two former Tesla engineers, Gene Berdichevsky and Alex Jacobs, and Georgia Tech materials science professor Gleb Yushin launched Sila in 2011. After initially sharing lab space at Georgia Tech, Sila received backing from venture capital firms and federal programs, including ARPA-E, to fund basic research and development. This initial private and public sector support allowed Sila to move into a proof of concept stage of development, before reaching pre-commercial demonstration in 2017. In 2022 Sila finally achieved its first commercial operation, delivering anodes to Whoop for its fitness tracker. The company is building a larger facility in eastern Washington state where it will manufacture anodes for Mercedes Benz’s fleet of electric G Wagons.

>>>READ: R&D tax change is impeding American innovation

While Sila’s transformation from a shared lab at Georgia Tech to a provider of anodes for one of Mercedes’ most luxurious vehicles may be impressive, it was also expensive and difficult to achieve. The company had to raise $925 million from private investors and $123 million from federal programs for the scaleup of its Titan Silicone anode. Furthermore, it took 11 years for the company to reach commercial operation.

Countless startups must navigate a myriad of challenges before they can begin to turn a profit. One of these challenges is unclear regulations, specifically permitting. As a report from Politico highlighted:

One person whose company received a DOE grant said their project’s required federal environmental review — a notoriously laborious and lengthy process — is behind schedule. So for now, the company can access only a fraction of the money it has been awarded.

During a recent webinar on early-stage innovation hosted by C3 Solutions, Michael Bruce of Emerson Collective—a group that funds various startups—provided an anecdote to further emphasize this problem. “One of our companies is in lithium and got a DOE grant. We learned a few months ago that they would need to go through a full [Environmental Impact Statement] before accessing their grant. It was estimated to take three to five years, but [the funding] was appropriations that [will go] away in 2026.”

Because of delays in the permitting process, the company will not be able to access its grant money. This not only wastes the man-hours spent on the grant application but it will also set the company back in its journey to scale up.

Apart from modernizing the permitting process, the BPC report also emphasized the need for consistent federal support for R&D funding regardless of political parties. Regular support across the lifecycle is critical to providing market certainty to startups and investors and ensuring that innovations are scaled up in the U.S.

BPC’s report provides real-world case studies of the opportunities and challenges that startups face. The U.S. is a world-class leader in research, development, and innovation. Fixing the problems that unnecessarily inhibit the commercialization process will make it even stronger.

The views and opinions expressed are those of the author’s and do not necessarily reflect the official policy or position of C3.